"SteveLehto" (stevelehto)

"SteveLehto" (stevelehto)

10/03/2014 at 13:00 • Filed to: None

47

47

100

100

"SteveLehto" (stevelehto)

"SteveLehto" (stevelehto)

10/03/2014 at 13:00 • Filed to: None |  47 47

|  100 100 |

What do you do when someone asks you to cosign a loan? Depends on how closely the person is related to you but - as an attorney - my advice generally is, "RUN!"

A customer walks into a showroom and finds a pricey car they want to buy. The dealer runs their credit and discovers it is less than stellar. The bank will not approve a loan to that borrower without a cosigner. There are other options, one of which is to find a less expensive car. But no one likes that. "Know anyone who might cosign the loan for you?"

Cosigning a loan is quite common in some settings and there is often a family relationship between the signers. Husband and wife, parent and child, or grandparent and grandchild. Of course, there is no requirement that there be any such relationship between the signers on the loan and I have seen roommates who have signed for one another, or neighbors, or even friends.

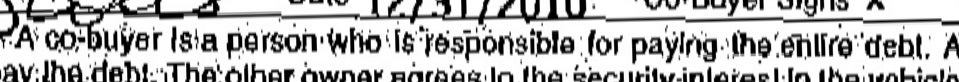

Many of these people did not understand the full implications of their actions. Which is all the more surprising considering that most modern loan documents contain warnings for cosigners. One sitting on my desk right now reads:

"A co-buyer is a person responsible for paying the entire debt."

If you are the cosigner, I would hope that you would recognize that you are also known as a "co-buyer" in this transaction. But what is not written in this sentence is just as ominous as what is.

It does not say, "We will go after the primary borrower and exhaust our remedies against them before we pursue the co-buyer for this debt." It does not say, "We will only come after you as a last resort."

In many states, the lender is legally allowed to come after you, the cosigner, first. And if they are allowed to, they will . After all, the primary borrower is the one who had the bad credit requiring a cosigner in the first place. Between the two of you, you are the one who is most likely collectible. In the interest of efficiency, why would they waste their time pursuing someone else first? They'll come after you.

And in the states where they can't come after you first? They can come after you once they have tried to collect from the primary borrower. Again, if the primary is not collectible - or has disappeared - you will find yourself in an ugly situation.

I have heard many horror stories over the years. Woman cosigns for her boyfriend who immediately disappears to another state with the collateral and never makes a payment. Man cosigns for his niece right before his sister reignites a family feud and tells her daughter to stop making payments Cosigner gets a notice in the mail that the vehicle was wrecked but had no insurance coverage; there is now an outstanding debt in need of payment. All my stories are from Michigan. Feel free to consult a local attorney and ask about the horror stories in your state.

Or, check out this !!!error: Indecipherable SUB-paragraph formatting!!! from the Federal Trade Commission.

So, as your pen hovers over the co-buyer or co-signer signature line, read that sentence a few more times before you commit. "A co-buyer is a person responsible for paying the entire debt." Ask yourself how you will feel when the other buyer on the contract defaults and leaves you being chased by the lender. You okay with that? If it is a spouse or a near relative, you might be fine with it. Sign away. If the other party is a neighbor or someone you met in rehab, you may want to think about it some more. And RUN!

Follow me on Twitter: !!!error: Indecipherable SUB-paragraph formatting!!!

Photo courtesy of author.

Steve Lehto is a writer and attorney and has been practicing consumer protection and !!!error: Indecipherable SUB-paragraph formatting!!! for 23 years in Michigan. He taught Consumer Protection at the University of Detroit Mercy School of Law for ten years and wrote !!!error: Indecipherable SUB-paragraph formatting!!! . He also wrote !!!error: Indecipherable SUB-paragraph formatting!!! and !!!error: Indecipherable SUB-paragraph formatting!!!

!!! UNKNOWN CONTENT TYPE !!!

Bad Idea Hat

> SteveLehto

Bad Idea Hat

> SteveLehto

10/03/2014 at 13:19 |

|

I just had a chill go down my back, the feeling that someone is about to hit me up for money.

SteveLehto

> Bad Idea Hat

SteveLehto

> Bad Idea Hat

10/03/2014 at 13:21 |

|

Probably. Or worse, ask you to co-sign a loan for a pair of personal water craft.

Don't Mess With Red

> SteveLehto

Don't Mess With Red

> SteveLehto

10/03/2014 at 13:24 |

|

SteveLehto

> Don't Mess With Red

SteveLehto

> Don't Mess With Red

10/03/2014 at 13:25 |

|

Wait. Is she offering to co-sign for me, or angry that I won't co-sign for her?

Don't Mess With Red

> SteveLehto

Don't Mess With Red

> SteveLehto

10/03/2014 at 13:27 |

|

FORTUNATELY FOR YOU, THIS ISN'T ABOUT YOU!! DON'TMESSWITHRED! :)

SteveLehto

> Don't Mess With Red

SteveLehto

> Don't Mess With Red

10/03/2014 at 13:29 |

|

The more I look at her, the more credit-worthy she looks!

Textured Soy Protein

> SteveLehto

Textured Soy Protein

> SteveLehto

10/03/2014 at 13:41 |

|

Shortly after he graduated college, my brother got a job in Baltimore, and wanted to get a car. But he had no credit history whatsoever. He arrived at the decision to lease a Subaru Impreza, and convinced my dad to co-sign the lease with him.

My brother is not the most responsible person, and my dad is rich.

My brother proceeded to crash the Impreza multiple times, generally beat it to hell, lost his job in Baltimore, found a new job in DC where we grew up, rented a room in a house where he claimed to my parents that he had a parking space but did not, racked up almost $1000 worth of parking tickets, crashed the Impreza some more, and due to various other irresponsible life decisions moved back in with my parents, where he crashed the Impreza some more.

When he crashed the Impreza while living with my parents, he told my dad he would take it to get fixed, but he didn't actually have the money to have the car fixed, and his car insurance company dropped him. So he "hid" the car by parking it 6 houses down the street. My parents' street is A LOOP , and they have a dog, which they take out for walks. So of course, my dad took the dog for a walk, and was like, "uhh what is your still-bashed-up car doing parked down the street, my idiot son?"

The car sat, un-fixed, for a while, because after this latest crash, my parents refused to let him drive without insurance, and my brother apparently is unaware of the existence of high-risk car insurance companies. He eventually moved out of my parents' house in the suburbs and back into the city, where he had nowhere to park, so he just left the busted up Impreza parked in front of my parents' house.

All the while, my brother was less than stellar about making the lease payments on time. He never got sent to collections, but my dad discovered when he wanted to refinance his mortgage, that my brother's late payments had affected his credit score. It was still good, but had dipped below 800.

In order to make sure to get the best rates on this mortgage refinancing and fix his credit rating, my dad ended up making most of the remaining lease payments, and paying to fix all the damage my brother had done, so that the car could be turned in at the end of the lease in good condition.

As for my brother? He still doesn't have a car, and I doubt he's even considered offering to try to pay my dad back for the lease payments and repairs.

SteveLehto

> Textured Soy Protein

SteveLehto

> Textured Soy Protein

10/03/2014 at 13:44 |

|

The story is hilarious, and sad, and - strangely - just like so many other stories I have heard. Thanks for sharing it!

Textured Soy Protein

> SteveLehto

Textured Soy Protein

> SteveLehto

10/03/2014 at 13:49 |

|

Let's just say I have many more stories like this about various members of my family. You know how everyone thinks their family is crazy? Mine actually is. Recognizing—and laughing at—the absurdity of all is how I keep from joining the crazy party.

SteveLehto

> Textured Soy Protein

SteveLehto

> Textured Soy Protein

10/03/2014 at 13:51 |

|

And refusing to cosign loans for them goes along with that I assume, yes?

Bad Idea Hat

> Don't Mess With Red

Bad Idea Hat

> Don't Mess With Red

10/03/2014 at 13:56 |

|

You are the best novelty humor account.

Textured Soy Protein

> SteveLehto

Textured Soy Protein

> SteveLehto

10/03/2014 at 14:01 |

|

Well, pretty much my brother is the only one I'd have to worry about, and he went to my dad. Back when he lived in Baltimore I "loaned" him a few hundred dollars a few times, because even though he had a halfway-decent paying job, he couldn't make rent because he spent all his money on booze and weed. He of course has never offered to pay that money back.

My paternal grandfather is crazy, but invented various radar things in the 40s and made a bunch of money on the patents, plus draws pensions from both NASA and the University of Chicago.

My maternal grandmother is crazy, but my now-deceased maternal grandfather owned a big civil construction company and she has a comfortable nest egg. Not that she knows how much is actually in it.

My mom's crazy, but my parents are rich, and careful with their money.

My aunt's crazy and doesn't have a ton of money but generally keeps a tight budget.

My uncle's crazy, makes lots of money, and spends even more money. He recently put his gigantic-ass $1.6 million house on the market and moved into somewhere cheaper, but asked my mom to loan him $100,000 "to help carry him until the old house sells." She said no.

So...I'm safe from being hit up by them financially. Just have to be careful about all that crazy.

JEM

> Textured Soy Protein

JEM

> Textured Soy Protein

10/03/2014 at 14:22 |

|

Totally random, but your grandfather isn't John Hay s Hammond is he?

WhiskeyGolf

> SteveLehto

WhiskeyGolf

> SteveLehto

10/03/2014 at 14:53 |

|

My dad cosigned for my first car when I graduated university in 2010, on a lease. It's never been a problem and I didn't need a cosigner for my current car, but he's probably the only person I'd ever ask or trust to handle that.

SteveLehto

> WhiskeyGolf

SteveLehto

> WhiskeyGolf

10/03/2014 at 14:58 |

|

When it works out, it's great. Someone else posted the exact opposite father-son story in this thread. I'd be curious to know what the real-life ratio is of good stories to bad. My world is skewed since people only bring me their wreckage and ask for help.

Thanks for the note.

Textured Soy Protein

> JEM

Textured Soy Protein

> JEM

10/03/2014 at 15:26 |

|

Nope . But he kinda invented weather radar .

Ry-bones, FiST pilot

> SteveLehto

Ry-bones, FiST pilot

> SteveLehto

10/03/2014 at 16:12 |

|

This dude will definitely not be wearing a shirt when he asks.

The Old Man from Scene 24

> SteveLehto

The Old Man from Scene 24

> SteveLehto

10/03/2014 at 16:15 |

|

So, if the finance company goes after the co-signer, who then proceeds to make payments on the vehicle, can the co-signer then go after the buyer and legally take possession of the car?

BTW, it's not just men that skip out on women who have co-signed a loan for them.

I had a male colleague (who I thought was smart enough to know better) who co-signed a loan for a brand new Z3 convertible for his then-girlfriend, who was 15 years his junior. GF then skipped town for parts unknown a few months later. I think he eventually tracked her to Austin or San Antonio and then the trail went cold.

irisfailsafe5000

> SteveLehto

irisfailsafe5000

> SteveLehto

10/03/2014 at 16:16 |

|

My aunt convinced my dad to co-sign a loan to buy a new car and also co-sign her apartment lease because she had bad credit. My father never asked for updates on her finances and one day he got a called that he was on the bank's blacklist. It turns out she ever finished paying the car nor paying the rent. The debt grew to over 15 grand and bankrupt my father. That lesson will always stay with me.

SteveLehto

> The Old Man from Scene 24

SteveLehto

> The Old Man from Scene 24

10/03/2014 at 16:17 |

|

I'm sure it varies from state to state but co-signing does not necessarily give you ANY rights of ownership. You just agreed to pay.

I'm sure deadbeats come in all shapes, sizes, genders, sexes etc. Those were just three that I saw happen in the course of my practice.

Thanks for the note.

SteveLehto

> irisfailsafe5000

SteveLehto

> irisfailsafe5000

10/03/2014 at 16:18 |

|

Wow. It is sad that relatives would do that to you. Think about it - you're doing THEM a favor.

Thanks for the note.

MiaImaCop

> Textured Soy Protein

MiaImaCop

> Textured Soy Protein

10/03/2014 at 16:18 |

|

You are very liberal with the term crazy.

jariten1781

> SteveLehto

jariten1781

> SteveLehto

10/03/2014 at 16:19 |

|

I've co-signed a few times for family and I always treat it the same way as I treat loaning them personal money.

Can I afford not to be paid back? Am I close enough to them that I can be out this money and not hold it against them?

If either answer is no then I don't co-sign. It's a gift with some likelihood of being returned but no guarantees.

desertdog5051

> SteveLehto

desertdog5051

> SteveLehto

10/03/2014 at 16:20 |

|

Great advice Steve. I was once asked to co-sign and had second thoughts. I did not do it. That was the smartest thing I have done in a long time. The borrower found another person and a few months after, the guy and the car disappeared.

SteveLehto

> jariten1781

SteveLehto

> jariten1781

10/03/2014 at 16:21 |

|

Which is precisely how this needs to be approached.

Thanks for the note.

Kanomikins

> SteveLehto

Kanomikins

> SteveLehto

10/03/2014 at 16:22 |

|

You never sign one of these loans. Not ever. You don't do it. Unless your mother is lying in the hospital dying, ok maybe possibly if there is no out. But for a shit head brother who wants a damn car? Forget it.

MR.Z06

> Textured Soy Protein

MR.Z06

> Textured Soy Protein

10/03/2014 at 16:22 |

|

As Steve said funny but sad. I'm sorry your brother is such a fuck up and I feel bad for your dad.

SteveLehto

> desertdog5051

SteveLehto

> desertdog5051

10/03/2014 at 16:22 |

|

You dodged a bullet.

Thanks for the note.

Textured Soy Protein

> MiaImaCop

Textured Soy Protein

> MiaImaCop

10/03/2014 at 16:22 |

|

You obviously have not met my family.

SidewaysOnDirt still misses Bowie

> SteveLehto

SidewaysOnDirt still misses Bowie

> SteveLehto

10/03/2014 at 16:23 |

|

How can people not get that they're saying that they're good for it if the primary isn't?

SteveLehto

> Kanomikins

SteveLehto

> Kanomikins

10/03/2014 at 16:23 |

|

That's the thing. Many people would never even think of ASKING for someone to co-sign. They are usually the ones responsible enough to make the payments. Then there are the people who don't care - and they ask.

Thanks for the note.

negativezero89

> SteveLehto

negativezero89

> SteveLehto

10/03/2014 at 16:25 |

|

I was lucky enough to have great parents who co-signed on both my car, AND my house. They were lucky enough that I'm responsible and have never missed a payment (okay, I was late one time on the car, but that was an aberration, I swear!). The car has been paid off for years now. The mortgage on the other hand has many years to go.

But as you point out, that's when you should co-sign, when you know the person you're signing for is trustworthy. Otherwise, they had best heed your advice.

SteveLehto

> SidewaysOnDirt still misses Bowie

SteveLehto

> SidewaysOnDirt still misses Bowie

10/03/2014 at 16:25 |

|

Some people are too trusting, and some people really don't understand this. Of course, you should never sign a document committing you to an agreement you don't understand but that is another story altogether.

marshamallow

> SteveLehto

marshamallow

> SteveLehto

10/03/2014 at 16:26 |

|

This is why you shouldn't cosign a vehicle.

A guy I work with consigned for a friend. The friend let his insurance lapse, totaled this thing, and now my coworker's credit is toast.

SteveLehto

> negativezero89

SteveLehto

> negativezero89

10/03/2014 at 16:26 |

|

Nice. And there are situations where it makes complete sense and it works out. Like yours.

Thanks for the note. And obviously, Go Wings!

negativezero89

> Textured Soy Protein

negativezero89

> Textured Soy Protein

10/03/2014 at 16:27 |

|

Sounds a lot like my friend's brother. My friend's parents are great people. Smart, responsible, just all around good. My friend is very much the same. Very responsible with his money, has a good job, takes care of his family etc. His brother is just train-wreck after train-wreck. There's lots of crazy in his extended family, but all of it manifested in his brother only for his immediate family.

Jared Glentz

> SteveLehto

Jared Glentz

> SteveLehto

10/03/2014 at 16:27 |

|

lawl cosigns...... if you cant afford it and you have shit credit......guess what i aint cosigning shit! your ass is buying a 500-1000 beater car!

SteveLehto

> marshamallow

SteveLehto

> marshamallow

10/03/2014 at 16:27 |

|

That is one of the examples I gave above (not your friend but that scenario). You really are taking on a HUGE risk when you co-sign a loan and if you are not REALLY close with the borrower, you will find that ALL kinds of things can go wrong - and come back to bite you.

Thanks for the note.

StephenWuebker

> SteveLehto

StephenWuebker

> SteveLehto

10/03/2014 at 16:28 |

|

My dad co-signed the loan for the first car I bought after college. I made every payment on-time or early. (I usually just paid more than I needed to pay every month) On my second car, I went through the same bank in my small hometown and they said I would need my dad to cosign again. Here's where it gets fun.

By the time I financed my second car, my credit pretty much OK, but my dad's had taken some decent hits due to changing jobs and some stuff with my siblings' student loans. Why would someone with OK credit need a cosigner with not-as-OK credit?

I have a feeling the bank was trying to help him out by putting him on a note they knew would be paid. Does cosigning work that way? Side note: I'm OK with that and small town banks are awesome.

SteveLehto

> Jared Glentz

SteveLehto

> Jared Glentz

10/03/2014 at 16:28 |

|

There is much wisdom in your comment. And that is one of the major points here - if you can't afford it without a co-signer, you really can't afford it, can you?

SteveLehto

> StephenWuebker

SteveLehto

> StephenWuebker

10/03/2014 at 16:30 |

|

I am not an expert on how the credit works in this situation. I am not sure if it can HELP the co-signer. I do know that it can hurt the co-signer. I know that a lot of banks will ask for co-signers just to double the number of people they can chase if the loan goes bad.

shop-teacher

> Textured Soy Protein

shop-teacher

> Textured Soy Protein

10/03/2014 at 16:35 |

|

"uhh what is your still-bashed-up car doing parked down the street, my idiot son?"

HA! Anybody else read that in your own Dad's voice, like I did?

Jonathan Woodall

> SteveLehto

Jonathan Woodall

> SteveLehto

10/03/2014 at 16:35 |

|

I had a woman come into buy a car (any car) with her boyfriend. She wanted her boyfriend to be the primary and her mom to be the cosigner because she had some repossessions... The trick to it was that mom and boyfriend refused to ever be in the same room together so they wanted boyfriend to sign his part of the paperwork and then she would come back later with her mom so she could sign her half and then get the car. I just wanted to scream DO NOT DO THAT!!!!! but I can't really do that. We just ran it and fortunately it just wasn't going to work out well even doing it that way so we didn't have to do the deal. In my mind, there was just no way that was going to end well!

presidentarthur

> Textured Soy Protein

presidentarthur

> Textured Soy Protein

10/03/2014 at 16:35 |

|

"...my dad discovered when he wanted to refinance his mortgage, that my brother's late payments had affected his credit score."

This, I would think, would be the main warning that should be issued.

Because it ought to be obvious to anyone that the point of co-signing on a loan is that one is guaranteeing performance in case the primary lendee defaults.

Jimmy Joe Meeker

> SteveLehto

Jimmy Joe Meeker

> SteveLehto

10/03/2014 at 16:36 |

|

It doesn't always go badly. I co-signed for my brother, he paid off the car and eventually I bought it from him. But it wasn't taken lightly, I knew the odds of him defaulting were approximately zero. Anyway it's now my basic commuter car, bad weather car, and car for hauling stuff.

shop-teacher

> SteveLehto

shop-teacher

> SteveLehto

10/03/2014 at 16:36 |

|

It's always amazed me how willing people are to cosign for other people's stuff. There's literally nobody that I would trust enough to cosign for, except for my wife ... but there's no need there.

SteveLehto

> Jonathan Woodall

SteveLehto

> Jonathan Woodall

10/03/2014 at 16:37 |

|

Wow. Makes you wonder about those family dynamics!

MechE30

> SteveLehto

MechE30

> SteveLehto

10/03/2014 at 16:37 |

|

As a general rule: anytime you're dealing with your money and another person, be prepared to completely wipe you hands of that full amount.

BigBadSubaru

> SteveLehto

BigBadSubaru

> SteveLehto

10/03/2014 at 16:37 |

|

The one and only time that I had someone ask if I would cosign a car loan for them, I told them I wanted on the paperwork listed as an owner, so that if they defaulted on the payment I could get the car, wanted a signed agreement that I would get the car if it was at risk of getting impounded, etc.. and told them I wanted a key, just to cover my ass. They ended up finding someone else to cosign for them. :-P It went ok they made I think one late payment and it gave the cosigner enough of a boost to their credit score they were able to get a decent interest rate on a home loan.

SteveLehto

> Jimmy Joe Meeker

SteveLehto

> Jimmy Joe Meeker

10/03/2014 at 16:38 |

|

You're right. It's just you have to know what you might be getting yourself into. Which really means how much do you trust the other person?

Thanks for the note.

SteveLehto

> shop-teacher

SteveLehto

> shop-teacher

10/03/2014 at 16:39 |

|

I agree with you on that. The number of people I would even consider doing that for is approaching zero.

fink stinger

> SteveLehto

fink stinger

> SteveLehto

10/03/2014 at 16:40 |

|

Oh, the stories. Best one I can dust off was a couple of high school buddies that had the bright idea of co-owning a new boat would make a great graduation gift to themselves. Michigan is full of great inland lakes and some of these have babes galore during the warm season. The first month was exactly how they dreamed it would be. They were both pretty good looking farm boys with a fancy new boat, so you can just imagine how it went. By about month three, they were scraping for beer and gas money. The boat was reposessed before the snow fell. They both paid for years, but the friendship fell apart pretty quickly when they weren't able to pay at the same rate.

SteveLehto

> BigBadSubaru

SteveLehto

> BigBadSubaru

10/03/2014 at 16:40 |

|

Cool. Thanks for the note.

ranwhenparked

> SteveLehto

ranwhenparked

> SteveLehto

10/03/2014 at 16:40 |

|

My dad had to cosign on the first car I bought that was expensive enough to require a loan. I had a good job, but was right out of college and had zero credit history. Paid it off in a year, and he had no reason to worry.

Now, my deadbeat younger brother, I still have no idea what convinced him it was OK to sign off on that one.

SteveLehto

> fink stinger

SteveLehto

> fink stinger

10/03/2014 at 16:41 |

|

Boat purchases are a whole 'nother story.

Thanks for the note. What lake were they using it on?

davedave1111

> SteveLehto

davedave1111

> SteveLehto

10/03/2014 at 16:42 |

|

I was asked to co-sign a loan once, by someone who was closer to acquaintance than friend. I actually laughed at first, but it turned out they were serious. It also turned out that they didn't understand what they were actually asking me to do - they thought co-signing it was something like me giving them a reference. When I explained what it actually meant, they retracted the request.

I suspect that the kind of people who ask are the kind who don't understand the terms of loans they take out. Which, again, are not people you want to lend money to :)

BrianRad

> SteveLehto

BrianRad

> SteveLehto

10/03/2014 at 16:43 |

|

I co-signed a loan for my sister. I always thought she was paying on time and there were no problems. At her wedding 6 years later she came clean that she missed a few payments when she got laid off from one of her jobs and that they attempted to repo it twice, but she was not home. My step-mom was pretty smart and figured out that my sister was about to lose the truck and I was going to be on the hook. My parents bailed out my sister and got the note current. After that she never missed another payment.

Luckily for me it worked out.

SteveLehto

> davedave1111

SteveLehto

> davedave1111

10/03/2014 at 16:43 |

|

I have had several people tell me that: They thought a co-signer was like a reference. Again, know what you are getting yourself into before you sign anything.

Thanks for the note.

CaptainBoss

> SteveLehto

CaptainBoss

> SteveLehto

10/03/2014 at 16:43 |

|

And that is one of the major points here - if you can't afford it without a co-signer, you really can't afford it, can you?

I generally agree with this and, while I have a great job and great credit, if I wasn't in the position I'm in I'd personally rather drive a beater while I get my shit together than have a co-signer. That said, to play devil's advocate, I'm sure there are people out there who can absolutely afford a car but whose credit doesn't necessarily match up with their actual financial situation. A perfect example could be someone who cosigned for another's loan and got screwed. Just a thought.

Des W-C

> SteveLehto

Des W-C

> SteveLehto

10/03/2014 at 16:43 |

|

Good advice, Steve. As a trustee in bankruptcy (not an attorney, as in Canada we're a specific licence as opposed to a type of lawyer) I would add that it's important to remember that the same applies for any joint borrowing including, but not limited to, supplementary credit cards and of course the biggest one which is being a co-signer on a mortgage!

Textured Soy Protein

> shop-teacher

Textured Soy Protein

> shop-teacher

10/03/2014 at 16:44 |

|

Granted, that's not a verbatim quote. But my dad told me about discovering the car while walking the dog, and we both agreed it was a pretty poor attempt at "hiding" it.

SteveLehto

> BrianRad

SteveLehto

> BrianRad

10/03/2014 at 16:44 |

|

Wow. And you're right, you were lucky that someone else could step in and take care of that.

Thanks for the note.

DMCVegas

> SteveLehto

DMCVegas

> SteveLehto

10/03/2014 at 16:45 |

|

Well, having a co-signer to guarantee your loan isn't a picnic either. You don't want someone to hold that against you as a weapon either. Especially if that person is a parent.

I was 18 and bought a brand-new car which my parents agreed to cosign on. A few months later I got into a fight with my parents over something, and as I found out years later my father talked to my mother about trying to punish me by taking my keys away. It pissed him off, but she told him point blank that he had no legal right to do so. Being a cosigner means that you're responsible for the debt if the primary borrower fails to pay. It does NOT mean that you have any special entitlement to the vehicle itself. As it was my name and my name alone on the registration, he had no leg to stand on. Not to mention that after all I was an adult, and a responsible one at that given the fact that I hadn't missed a single payment nor been late. As she told him, if I stopped making the payments, maybe they could talk to a lawyer about taking ownership of the car perhaps *if* that was even possible. But otherwise, he had no right to the car. And if he did in fact try to take the keys, or worse yet hide the car from me, that could amount to auto theft that he could be arrested for.

Now my father wasn't a jerk or anything like that, it was as I imagine a moment of clouded anger. Likewise I'm sure he was not happy about being wrong, but it also drove the point home that I was no longer a child and I now had adult responsibilities that I was fulfilling. Again, he wasn't a jerk because after all he did back down and suddenly had pride in me. Which again is probably why I never heard this story until years after his death. I also found out that soon after this argument, he instead would brag about how he cosigned for a car loan for his son who had never missed a payment. It all went from pissing-off the old man because he could no longer control me, to him being able to gloat that he no longer had to worry about me.

Go figure.

SteveLehto

> Des W-C

SteveLehto

> Des W-C

10/03/2014 at 16:45 |

|

Yes, good point. Thanks for the note.

Kevin Rhodes

> SteveLehto

Kevin Rhodes

> SteveLehto

10/03/2014 at 16:46 |

|

All I have to say on this subject is that if the bank won't give you the money, neither am I. And for all intents and purposes, when you co-sign a loan, you might as well just give them the money.

SteveLehto

> DMCVegas

SteveLehto

> DMCVegas

10/03/2014 at 16:46 |

|

Cool story and good point. The ones with family members are often the most dramatic due to how families operate. Thanks for the story.

fink stinger

> SteveLehto

fink stinger

> SteveLehto

10/03/2014 at 16:47 |

|

Mostly Crystal Lake. In Crystal, of course (not of course, but a nice coincidence).

ProcessBlack

> SteveLehto

ProcessBlack

> SteveLehto

10/03/2014 at 16:47 |

|

I've co-signed for a bunch of loans but they were all for family members and my fiancé at the time. They're all people that would go get a second of third job in order to pay their debts so trust was never an issue. All of the loans were paid in full on time or even ahead of schedule. It also helped me to keep building credit while being in-between car purchases. Co-signing is fine as long as you A) know the person well enough to know they're not a risk and/or B) can pay off the debt yourself if necessary.

StephenWuebker

> SteveLehto

StephenWuebker

> SteveLehto

10/03/2014 at 16:47 |

|

OK, just did some quick searching. From what I can tell, the cosigned loan shows on both people's credit reports, so a loan that is repaid timely can actually help a cosigner's credit.

SteveLehto

> ProcessBlack

SteveLehto

> ProcessBlack

10/03/2014 at 16:47 |

|

AMEN. Thanks for the note.

SteveLehto

> fink stinger

SteveLehto

> fink stinger

10/03/2014 at 16:48 |

|

Okay. I am from SE Mich so I know the lakes in that area and some up north.

SteveLehto

> StephenWuebker

SteveLehto

> StephenWuebker

10/03/2014 at 16:49 |

|

Thanks for the note. I have friends who specialize in credit stuff so I was going to ask one of them.

April_N_

> SteveLehto

April_N_

> SteveLehto

10/03/2014 at 16:50 |

|

I think the advice on cosigning should be the same as loaning some one money... be prepared that you will never get that money back, and be prepared that you will have to be responsible for paying whatever you cosigned. If you can live with either of those facts, go ahead. Otherwise don't do it.

SteveLehto

> April_N_

SteveLehto

> April_N_

10/03/2014 at 16:51 |

|

Which is a great way of looking at it. Thanks!

Manwich - now Keto-Friendly

> Textured Soy Protein

Manwich - now Keto-Friendly

> Textured Soy Protein

10/03/2014 at 16:54 |

|

Great story.

I'm glad your dad didn't budge, let the car stay unfixed and wouldn't let him drive without insurance.

But as a father of two kids who will be driving in a few years, after the first or second collision, I would march them to the license office, have them cancel the drivers license and then apply fresh for a learners permit and some more thorough drivers education.

It's not so much the damage to the car I'd have a problem with. It's the lack of driving competence that is basically endangering others and themselves. That's the bigger and more important issue.

It's probably a good thing your brother doesn't have a car. I think a bicycle is more suited to him.

DNLM

> SteveLehto

DNLM

> SteveLehto

10/03/2014 at 16:56 |

|

Well the second part wouldn't necessarily be true. I have a couple of friends who were stupid and hook on drugs when they were younger but completely responsible now. That being said their credit cards destroyed their credit and they are hosed. That being said, I wouldn't trust them enough to co-sign either and would point them to a J.D Byrider type place.

Manwich - now Keto-Friendly

> Textured Soy Protein

Manwich - now Keto-Friendly

> Textured Soy Protein

10/03/2014 at 16:57 |

|

"he couldn't make rent because he spent all his money on booze and weed."

I had a friend I rented an apartment to like that. He also didn't seem to understand the concept of putting garbage in the garbage and cleaning things. He also didn't understand the concept of being honest and upfront about things.

SteveLehto

> DNLM

SteveLehto

> DNLM

10/03/2014 at 16:58 |

|

But the question is, do you want to take that risk?

Stephen

> SteveLehto

Stephen

> SteveLehto

10/03/2014 at 16:58 |

|

What % of car loans actually have a co-signer? I hope it's a low number.

SteveLehto

> Stephen

SteveLehto

> Stephen

10/03/2014 at 16:59 |

|

I don't know. I'd also like to know what number of them end up costing the co-signer.

DMCVegas

> SteveLehto

DMCVegas

> SteveLehto

10/03/2014 at 17:02 |

|

Hey, thank YOU for all the cool stories!

Family is always a tricky thing. I feel like mine was pretty normal overall, but both my parents warned me from a young age to never go in on a business deal with a family member, because they're always the first to screw you over. Other than this, and maybe one other thing, it's why we've never gotten involved on business things and been pretty happy.

Now my wife's family on the other hand... Oh boy. There are some stories to tell there. Though I'm sure you've heard many like them before.

SteveLehto

> DMCVegas

SteveLehto

> DMCVegas

10/03/2014 at 17:03 |

|

Thanks for the note. And even if they don't screw you, there is a high likelihood that things will turn ugly somewhere, sometime.

Tommy861

> SteveLehto

Tommy861

> SteveLehto

10/03/2014 at 17:09 |

|

My sister went with a "friend" to an Acura dealer. Said "friend" needed a car to get to work. That car happened to be a couple year old RSX, you know because when you're in the dumps barely have a job you should get an almost new car. The dealer convinced her to cosign the loan by telling her some BS how she wasn't responsible (at least that was her story), but as we know, she was . The best part, she cosigned his AUNT as the primary, he had such bad credit they wouldn't even let this kid put his name on it. So he gets the car, promptly defaults on the loan 2 months later and the car gets repossessed. Aunt has no money, guess who is on the hook for the difference? My idiot sister, $10,000. She worked a part time job at a gym at this time in her life. My parents ended up covering the debt and she is paying them back (supposedly).

I took it upon myself to try and contact both the aunt and the "friend" against her wishes to try and squeeze them for the money, they both basically told me to F off and her to F off as well.

SteveLehto

> Tommy861

SteveLehto

> Tommy861

10/03/2014 at 17:11 |

|

Wow. Some of these stories are amazing. But it is astounding how wildly these situations can spin out of control.

Thanks for the note.

pfftballer

> Textured Soy Protein

pfftballer

> Textured Soy Protein

10/03/2014 at 17:12 |

|

I feel you man. My sister is a full blown nut job.

Kanomikins

> davedave1111

Kanomikins

> davedave1111

10/03/2014 at 17:13 |

|

That's a sharp and important point. Dumb people just don't know.

Ultrakill

> SteveLehto

Ultrakill

> SteveLehto

10/03/2014 at 17:14 |

|

One time in college, freshman year, some guy who lived in the dorm room next to me who I barely knew, asked me to co-sign for him. I'm not sure if I just laughed in his face or told him "no way" or just completely ignored him. But that was probably the most awkward question a dude has ever asked me.

Manwich - now Keto-Friendly

> fink stinger

Manwich - now Keto-Friendly

> fink stinger

10/03/2014 at 17:14 |

|

Years ago, I had three friends who wanted to jointly purchase a "cottage".

I knew this was a bad idea right from the start.

The "cottage" was actually just a glorified trailer in an overpriced trailer park that advertised itself as a "resort".

Because I had prior knowledge of crap real estate "investments" like time shares, so with the 3 friends there, I grilled the hell out of the sales person... including getting her to concede that the purchase of one of their "cottages" didn't actually involve any land ownership... nor even a guarantee that their trailers couldn't be forced off the property of they decided to redevelop the land.

I'm proud to say that I convinced them not to do it and everyone is still friends.

irisfailsafe5000

> SteveLehto

irisfailsafe5000

> SteveLehto

10/03/2014 at 17:15 |

|

I know it doesn't make sense at all. That's why your post rang with me, you never know what you are signing for when you co-sign a loan. I once heard Suze Orman say don't sign anything if a family member needs money give it to them as a gift and never expect anything back, it's the only way things won't get ugly.

SteveLehto

> Ultrakill

SteveLehto

> Ultrakill

10/03/2014 at 17:16 |

|

That would be pretty weird . . . Thanks for the note.

Harris_the_Unknowing

> SteveLehto

Harris_the_Unknowing

> SteveLehto

10/03/2014 at 17:16 |

|

"Don't ask me to cosign a loan" is one of the few things I believed strongly enough in to have tattooed on my body.

SteveLehto

> irisfailsafe5000

SteveLehto

> irisfailsafe5000

10/03/2014 at 17:17 |

|

But no one will buy me a brand new car as a gift! WAAAAAAAAAAAAAAHHHHHHHHH!

(Thanks for the note.)

SteveLehto

> Harris_the_Unknowing

SteveLehto

> Harris_the_Unknowing

10/03/2014 at 17:17 |

|

Is it visible when you are in public?

fink stinger

> Manwich - now Keto-Friendly

fink stinger

> Manwich - now Keto-Friendly

10/03/2014 at 17:25 |

|

Dollars to donuts on you having saved that friendship.

jalop1991

> SteveLehto

jalop1991

> SteveLehto

10/03/2014 at 17:29 |

|

So, as your pen hovers over the co-buyer or co-signer signature line, read that sentence a few more times before you commit. "A co-buyer is a person responsible for paying the entire debt."

And then say, "Here, hold my beer, watch this" and then sign.

Same results. Every time.

SirPoopyPants

> SteveLehto

SirPoopyPants

> SteveLehto

10/03/2014 at 17:34 |

|

My dumb ass did it for my sister after she finished law school. She had never worked or had any credit cards so had 0 credit history so she needed me to co-sign for her car (parents wouldn't because she wasn't buying an American car... assholes). I agreed because I figured she had a high paying job so her making the payments wouldn't be a problem.

The payments weren't a problem. She paid the car off and never missed a single payment.

The problem? Well... she had never worked before and was generally oblivious to how the world worked. She thought you could use the iPass lanes and they billed you as part of your license plate renewal or some shit. Not sure how she didn't get any of the tickets in the mail but, she was blissfully unaware of the $30k in fines she had... until I wanted to buy a house and magically the IL Tollway collections people hit me with collections for her tolls.

JCAlan

> SteveLehto

JCAlan

> SteveLehto

10/03/2014 at 17:37 |

|

It's amazing how often the cosigner is actually NOT contacted and given a chance to pay when the loan goes bad. I see it all the time where someone's credit is trashed due to a loan they cosigned, and they had no idea until they went to buy a car themselves. ALSO, the fact that you have other loans in your name can prevent you from buying a car due to debt-to-income concerns even if the payments are being made on time.

SteveLehto

> SirPoopyPants

SteveLehto

> SirPoopyPants

10/03/2014 at 17:38 |

|

$30K in fines?!?!?!? Was the license plate in your name? I would have thought they'd go after the registration holder on the vehicle.

Just goes to prove that these things can go haywire in ways we could never predict.

Eric the RC guy

> DNLM

Eric the RC guy

> DNLM

10/03/2014 at 17:38 |

|

This. It wasn't drugs, just generally not being prepared to be an adult, but my credit sucks because of mistakes I made in the past (the primary one was going to college, but that's a story for another day). I now have a decent job that pays my bills, and I could afford payments on a car fairly easily, but because the only thing lenders look at is a number that supposedly tells them all they need to know about me there's no way in hell I can actually get a car (or for that matter, a house).

Fortunately my car still gets me to and from work every day and I've got a place to live in while I work to build my credit, but the whole system is purposely designed to screw the people that can least afford to be screwed.

SteveLehto

> JCAlan

SteveLehto

> JCAlan

10/03/2014 at 17:39 |

|

The overall debt figure is the one that so many people don't think about - you nailed it. If you co sign a loan, even if it is current, the outstanding portion will hang over you as part of your overall debt. So you have to ask yourself about future credit purchases you might want to make before this loan is paid off (Assuming it does get paid off.)